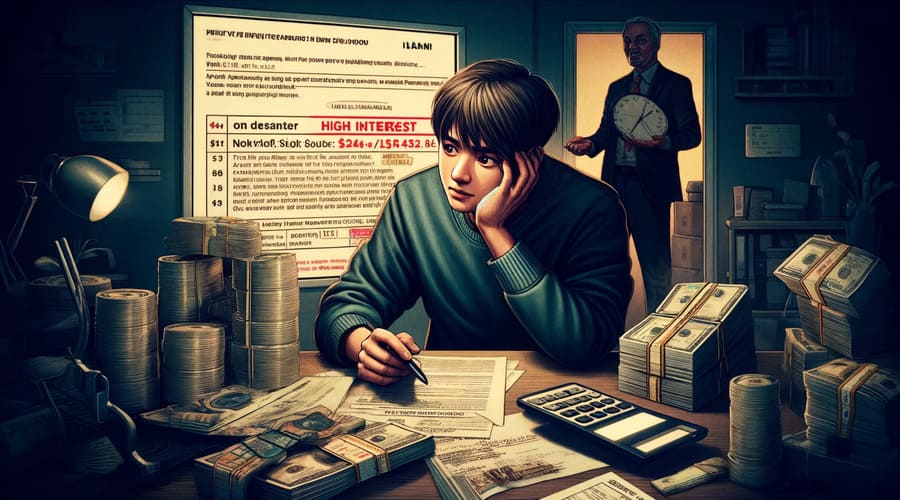

In an unpredictable world, having a financial safety internet isn't just a luxurious; it's a necessity. Emergency Fund Loans have emerged as an important useful resource for individuals facing unexpected bills. Whether you experience a sudden medical emergency, sudden automotive repairs, or job loss, understanding tips on how to navigate the complexities of securing an Emergency Fund Loan may imply the distinction between financial security and overwhelming debt. This article explores the intricacies of Emergency Fund Loans, their significance, and how to utilize them successfully to safeguard your future.